The assets of OJSC Expressbank for 2018 increased by 26%, reaching 395.2 million manat. According to the report, the market share of the loan and deposit portfolio of the bank increased.

During 2018, due to an increase in the current customer base, the loan portfolio of the bank increased by 33%, as a result, the bank's share in this segment increased by 27%. Compared to 2017, the issuance of loans in the direction of small and medium-sized businesses increased by 93%, reaching 51 million manat. The microcredit portfolio increased 2.5 times, and the mortgage lending increased by 85%.

Financial stability and customer confidence in the bank had a positive effect on the increase in the number of depositors, as a result of which the deposit portfolio for individuals increased by 25%, and the increase in current account balances reached 99%.

The active activity of Expressbank in the direction of promoting its products and services allowed the bank to increase its client portfolio for individuals by 23%, and for legal entities by 42%. The number of issued plastic cards increased by 37%, the turnover on non-cash transactions grew more than twice.

Among the new products and financial solutions provided by the bank to its customers, such products as Damla deposit, Qızıldan kart deposit, deposit cells, mobile applications Expressclub and Expresspay can be especially noted.

According to the results of activities in the direction of development of non-cash payments, Expressbank in 2018 was awarded several awards, namely:

Awards awarded by the Central Bank of Azerbaijan - “Bank-leader in the infrastructure of contactless POS terminals” - 2nd place; “Leading bank for contactless payment cards” - 2nd place; “The leading bank in non-cash payments” - 3rd place;

The award awarded by the MasterCard payment system for the largest increase in MasterCard Platinum, Black Edition and World Elite cards - 1st place;

Awards awarded by the Association of Banks of Azerbaijan, as a member of the ABA, introducing innovative solutions and for activities in the direction of corporate social responsibility.

According to the results of 2018, the total capital of the bank amounted to 115 million manat. Currently, in terms of capital adequacy, Expressbank is among the leading banks in Azerbaijan.

In 2018, the international rating agency Fitch Ratings confirmed the Expressbank credit rating for category B as stable. This rating is considered one of the highest among the banks of the country.

Expressbank has a network of 15 branches, nine of which are located in Baku and Sumgayit, six - in Ganja, Mingachevir, Bard, Gusar, Khachmaz and Shirvan. The bank has 70 ATMs throughout the country, more than 1000 POS-terminals and up to 700 Expresspay payment terminals.

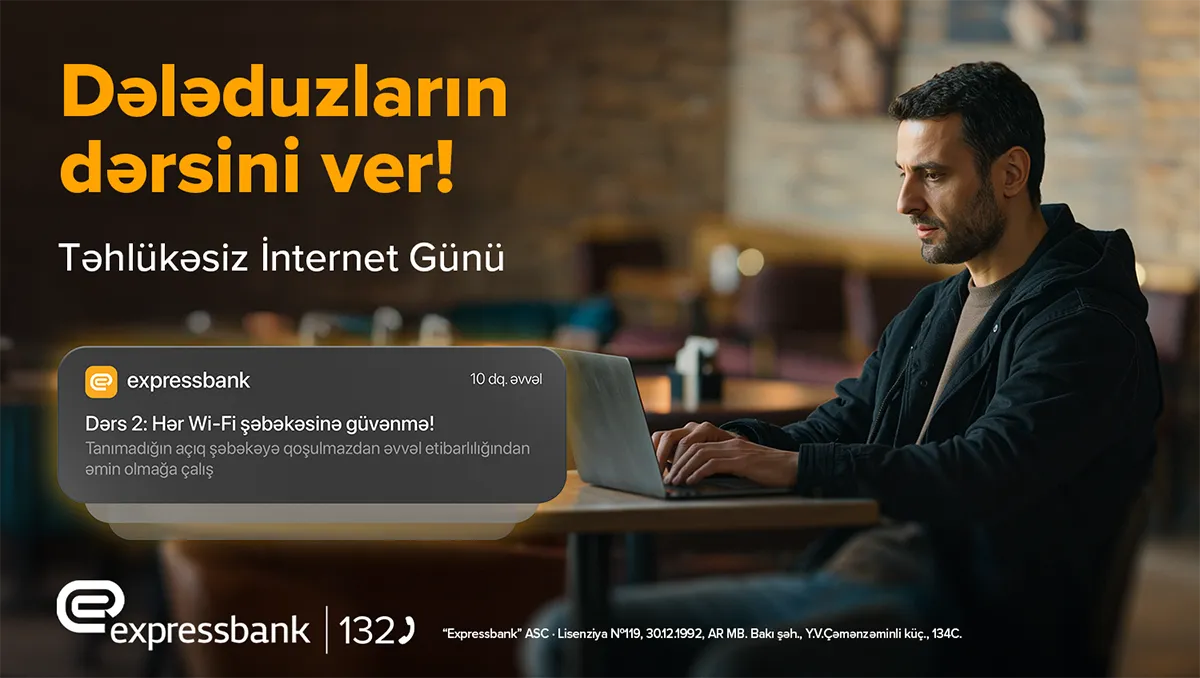

Detailed information about the bank and its services can be obtained by calling the Information Center at number 132, on the official website of the bank

www.expressbank.az and on the page on the social network www.facebook.com/Expressbank.